Disclaimer

All screenshots in the article were taken in the Dutch version of Yuki.

As much as possible, the invoices are recorded and checked by Yuki automatically. Then you can simply edit or change purchase and sales invoices yourself.

The 'Invoice actions' feature is only available to a user with the 'Back office' role in the domain or the 'Financial administration' or 'External accountant' role.

An invoice can be edited or changed from different places in Yuki:

- Click on the Invoice actions button in an opened invoice

- Click on the pencil after the invoice line from the GL account.

In case of changes via invoice actions Yuki will try to adjust the existing general journal entry as much as possible. Yuki will optimize the transparency of the administration and will try to keep the figures the same as the ones of the original invoice as much as possible. However, sometimes this doesn't work. In that case Yuki will create an additional general journal entry.

Edit from opened invoice

In order to edit or change an invoice you have to click the Invoice actions button in an opened invoice.

ATTENTION!

This button is only available in an invoice that has already been processed.

The following screen is now opened:

The following invoice actions functions are now available:

- Move revenue or costs to previous year

- Move revenue or costs to next year

- Move revenue or costs to previous month

- Move revenue or costs to next month

- Spread revenue or costs over a number of periods

- Change the GL account(s)

- Change the tax code

- Change the invoice number

- Change the payment method

- Change the exchange rate (only available in foreign currency invoice)

- Revalue (only available in foreign currency invoice).

Undo invoice action

It is always possible to undo the recording of an invoice action in a simple way. You just have to open the relevant invoice, then click the Invoice actions button and then click the Revert option.

The entries of the invoice action will be deleted and the invoice will change again, if applicable, in the original invoice.

Edit from GL account

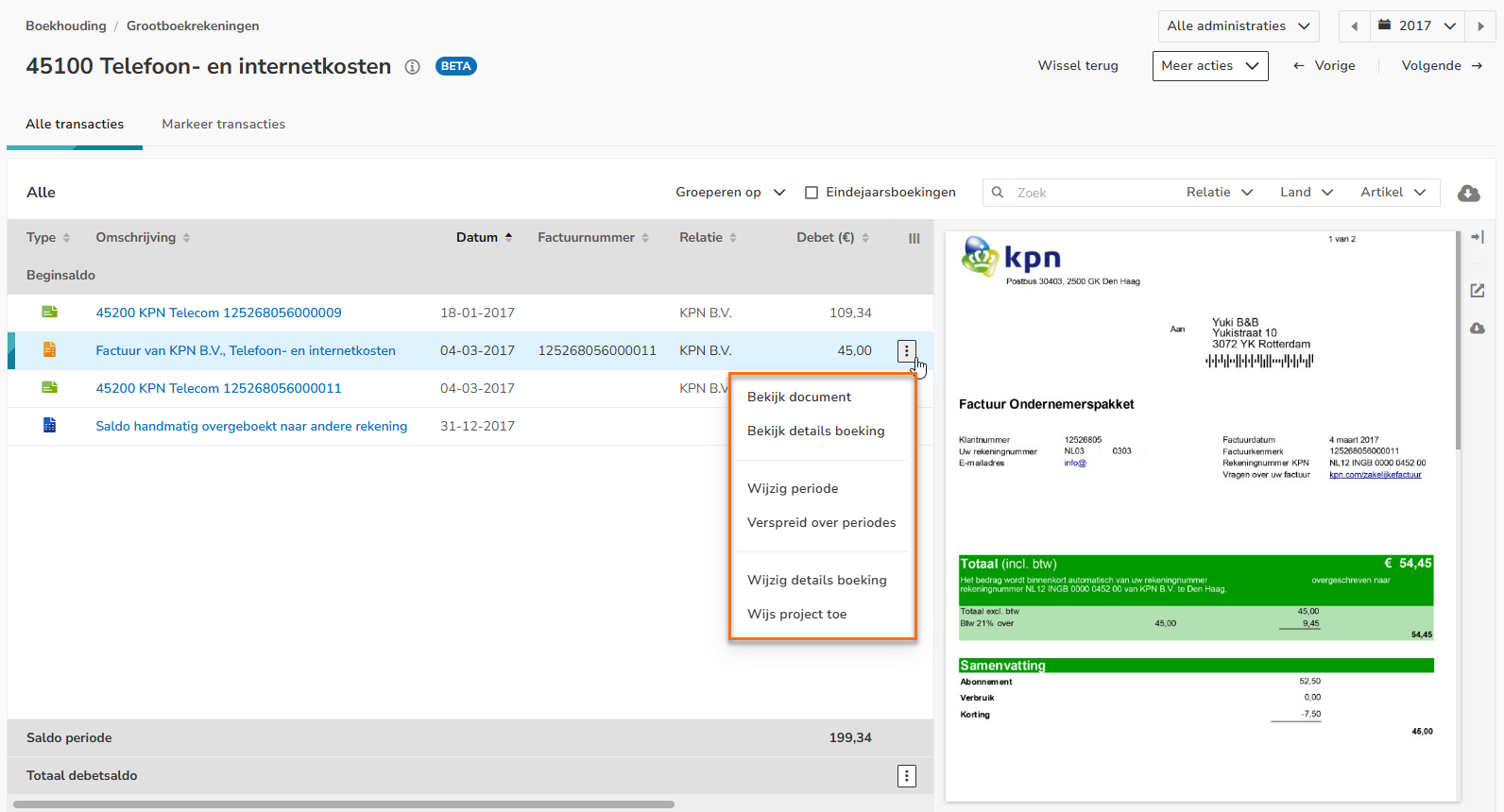

You can also use these invoice actions in a GL account that you for example have opened from the trial balance. When you notice that an invoice has been incorrectly posted or needs to be edited, hover your mouse over the line of the relevant invoice and click on the button with the three dots.

Via View entry details you can view the general journal entries that are recorded based on the invoice.

TIP!

When the 'Yuki projects' functionality has been activated an invoice can be assigned to another project via Assign project.

The following invoice actions functions are now available:

- Change period:

- Move revenue or costs to previous year

- Move revenue or costs to next year

- Move revenue or costs to previous month

- Move revenue or costs to next month

- Spread over periods:

- Spread revenue or costs over a number of periods

- Change entry details:

- Change the GL account(s)

- Change the tax code

- Change the invoice number

- Change the payment method (only available for the Debtors, Creditors or CA employees GL account)

- Change the exchange rate (only available in foreign currency invoice)

- Revalue (only available in foreign currency invoice).

Undo invoice action

It is always possible to easily reverse the booking of an invoice processing:

- Change the period: click on the button with the three dots and then select Revert period change from the dropdown menu.

- Spread periods: click on the button with the three dots and then select Revert spread over periods from the dropdown menu.

- Change project: click on the button with the three dots and then select Edit assigned project from the dropdown menu.

The entries of the invoice action are deleted and the invoice reverts, if applicable, to the original invoice.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article