Disclaimer

All screenshots in the article were taken in the Dutch version of Yuki.

In a fiscal unity, all administrations (companies) are considered as one company for VAT purposes. A fiscal unity often consists of a parent company (Holding) and one or more subsidiary companies (operating companies).

A fiscal unity does not pay VAT on supplies of goods and services between the companies.

All components of the fiscal unity have their own VAT return in Yuki. However, the fiscal unity files one VAT return for all administrations combined.

Therefore, the VAT accounting periods of the fiscal unity components must be the same as those of the fiscal unity itself.

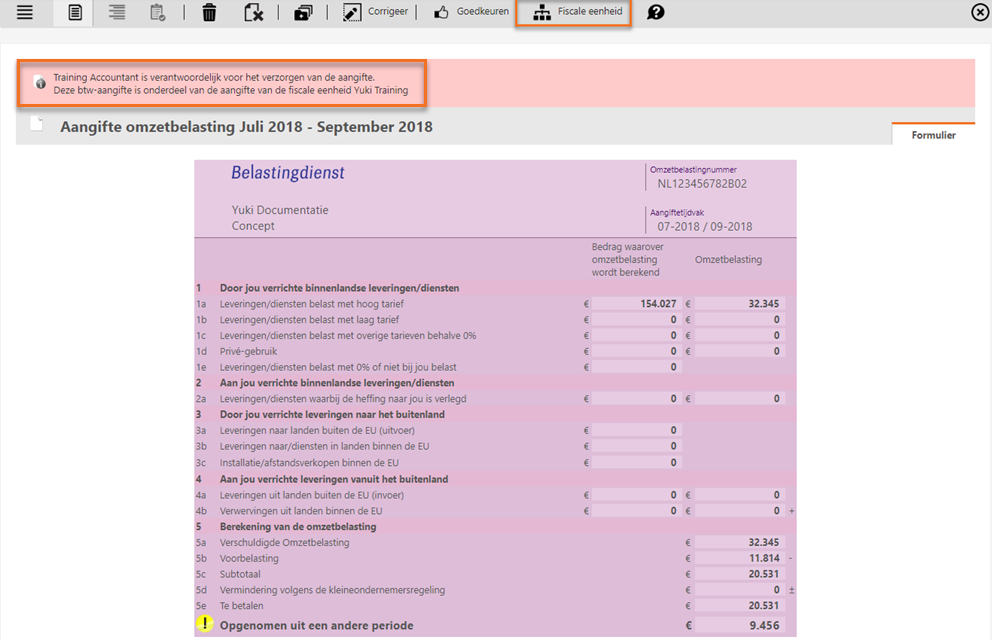

In the month following the VAT accounting period, a Fiscal unity button will appear in the VAT return of each component of the fiscal unity to transfer the relevant VAT return to that of the fiscal unity.

This closes the individual VAT returns, and they are given the status Posted to fiscal unity.

After that, the VAT return of the fiscal unity can be approved and then sent to the tax authorities.

The VAT return of the fiscal unity will be given the status Closed (in fiscal unity).

TIP!

If a VAT return is missing for a component of the fiscal unity for a VAT accounting period, a zero VAT return must be created for that VAT accounting period by clicking on the Create VAT return button in the VAT return overview in the top left corner of your screen.

This zero-VAT return must then be transferred to the fiscal unity's VAT return by clicking on the Fiscal unity button.

VAT return entries fiscal unity

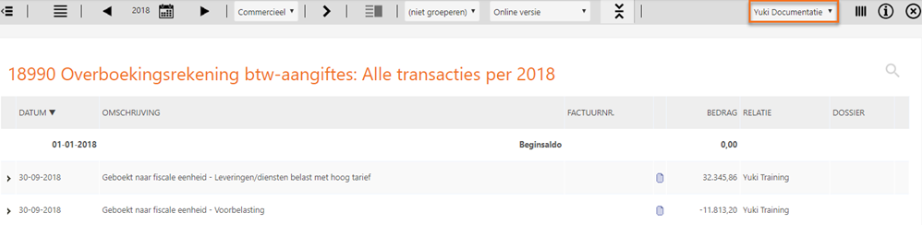

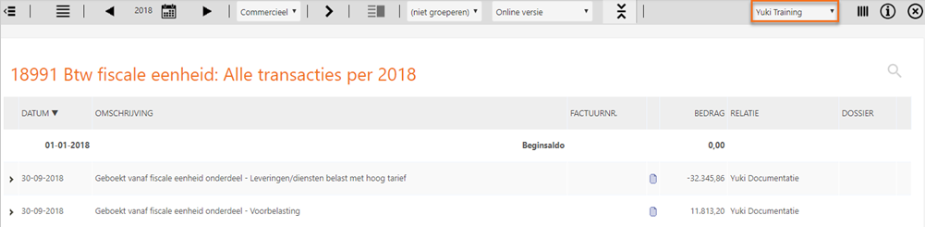

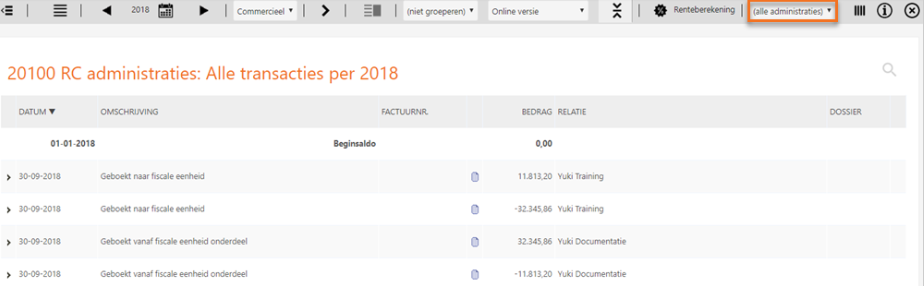

The individual VAT returns are transferred to the fiscal unity at the VAT line level. Additionally, Yuki also records the claims between the fiscal unity (parent) and the components of the fiscal unity (subsidiaries).

18990 VAT returns transfer account

18991 VAT fiscal unity

20100 CA companies

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article