Disclaimer

All screenshots in the article were taken in the Dutch version of Yuki.

As of October 6, 2011, the following regulation applies:

For a sole proprietorship, a portion of the VAT on maintenance and fuel costs can be reclaimed. The basis for this is the ratio between company and private use, which must be demonstrable from the mileage log, and only that percentage of the paid VAT can be deducted. Therefore, the starting and ending mileage of the car is stated on every kilometer declaration.

TIP!

To make use of the scheme, the receipts and invoices showing the VAT input tax must be processed in the Yuki administration.

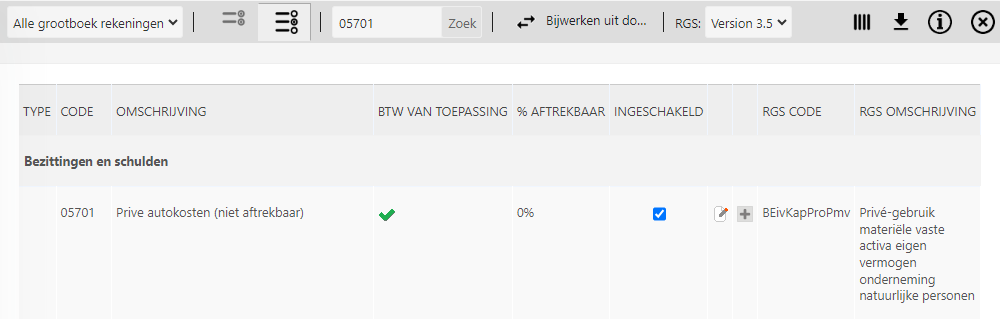

Receipts and invoices must be booked to '05701 Personal car costs (not deductible)'.

When booking the receipt or invoice, the VAT line is filled, but the amount will not appear in the VAT return.

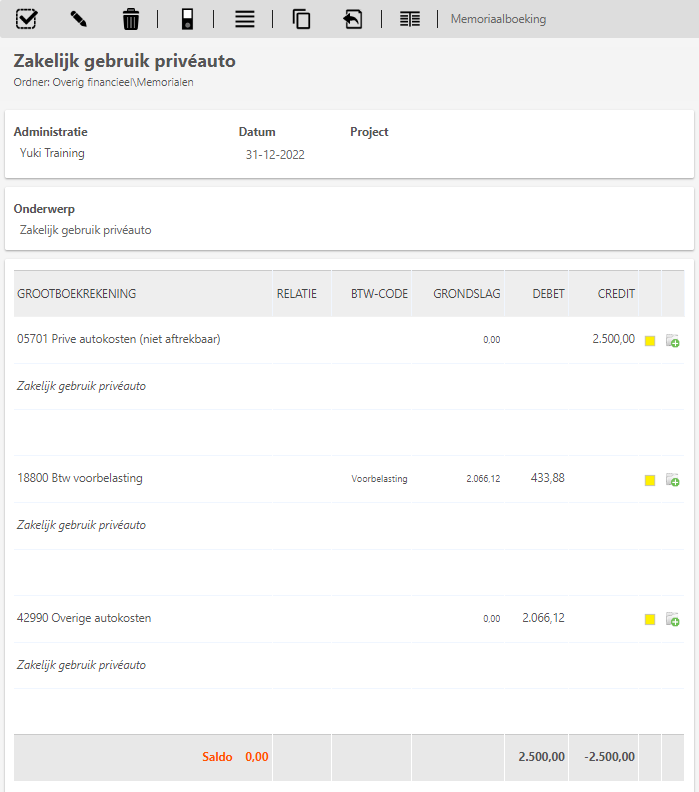

At the end of the year, the VAT from 'personal car costs' can be transferred to the input tax based on the calculated business percentage. If there are no other costs on that account beside those taxed at 21%, the VAT can be easily calculated back on the total.

This booking is entered on the last day of the previous financial year and can still be included in the final VAT return.

Example journal entry

ATTENTION!

The entrepreneur must state the mileage of his or her private car at the beginning of company use and also at the end of the year so that the business percentage can be calculated afterward. This can be done by stating the starting and ending mileage on each kilometer declaration so that the ratio can be easily calculated.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article