Disclaimer

All screenshots in the article were taken in the Dutch version of Yuki.

For a car registered in the company's name, you can reclaim the VAT on purchase, maintenance, and use (fuel) to the extent the car is used for taxable sales. This also applies to a leased car.

You do pay VAT for the private use of your company car, in the form of a VAT correction.

ATTENTION!

Submit the VAT correction for the previous year by January 31st.

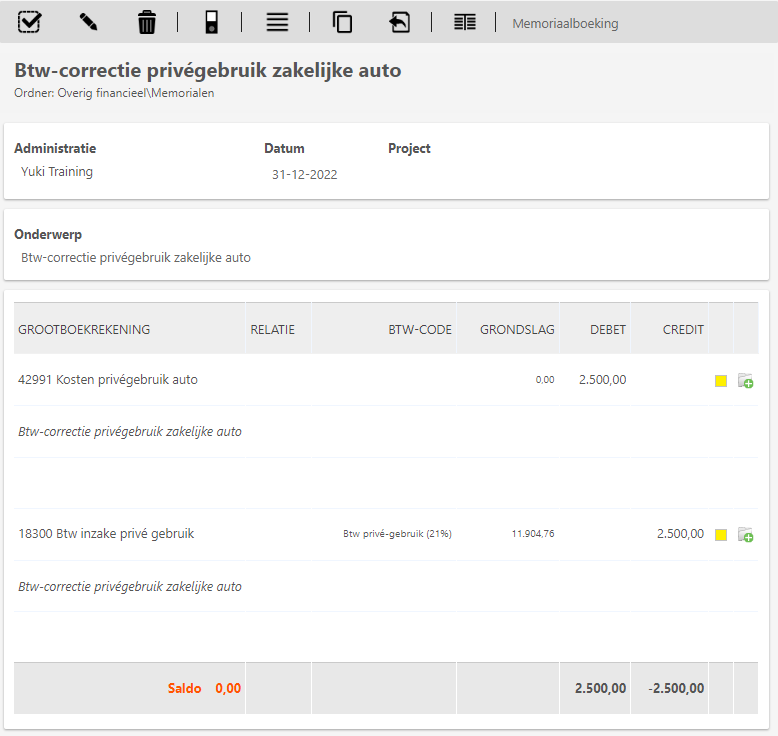

You can process the VAT on the private use of a company car by creating a manual journal entry.

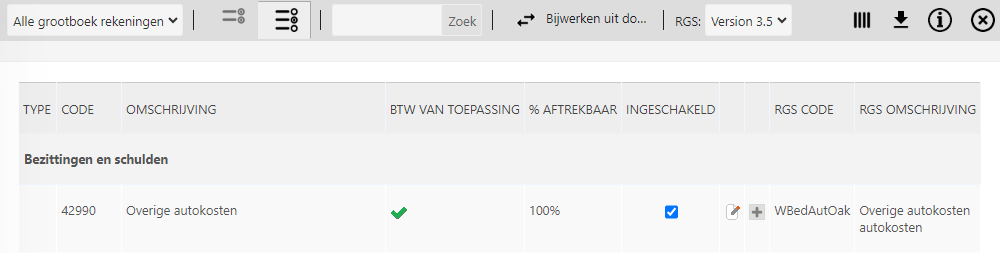

For the costs account, you can create an additional GL account, such as '42991 Costs of private use of car', via GL account '42990 Other vehicle costs'. Of course, you can also choose a different GL account if required.

For the VAT correction, GL account '18300 VAT on private use' can be used. The correct VAT code is automatically selected by Yuki. The amount of the VAT correction will then be entered in box 1d Private use of the VAT return.

Example journal entry

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article