Disclaimer

All screenshots in the article were taken in the Dutch version of Yuki.

In certain administrations, we encounter the margin scheme for VAT. This concerns car dealerships or used goods where VAT as input tax cannot be deducted due to purchases from private individuals or from entrepreneurs who supply exempt services. When selling these goods, VAT is only paid on the margin, but this VAT cannot be mentioned on the invoice and cannot be deducted as input tax by the buyer. The invoice only states that the transaction is subject to the margin scheme.

For the VAT return, there is a choice:

- Determine the profit margin properly (for example, by car) and pay VAT on it (also known as the individual scheme).

- Determine the profit margin per period across all margin purchases and margin sales combined and pay VAT on that (also known as the global margin scheme).

Generally, it is more advantageous to apply the global magin scheme because a negative profit margin in one period can be offset by a subsequent period, and even compensation across the year-end is permitted, which is not possible with the individual scheme. A negative profit margin in a quarter never leads to a VAT refund.

Individual scheme

If the customer chooses the individual margin scheme, they must keep detailed records of all margin goods and state the purchase price of each good on every sales invoice for Yuki, so that Yuki can process the correct VAT on the margin.

When purchasing under the margin scheme, VAT may not be booked as input tax in the purchase invoice.

When selling under the margin scheme, the purchase price of the good must be stated on the sales invoice uploaded to Yuki.

Example booking of sales invoice according to the margin scheme

The total sales amount including VAT is 700 euros.

The purchase price of the car was 600 euros, so the margin is 100 euros.

2 booking lines in sales invoice:

- revenue is 600 euros (exempt from VAT).

- revenue is 100 euros (including 21% VAT).

TIP!

If the VAT code 'Exempt revenue' hasn't been activated in the domain yet, click on the Settings icon in the navigation bar and then click on VAT rates in the now-opened screen. Then click on the New button.

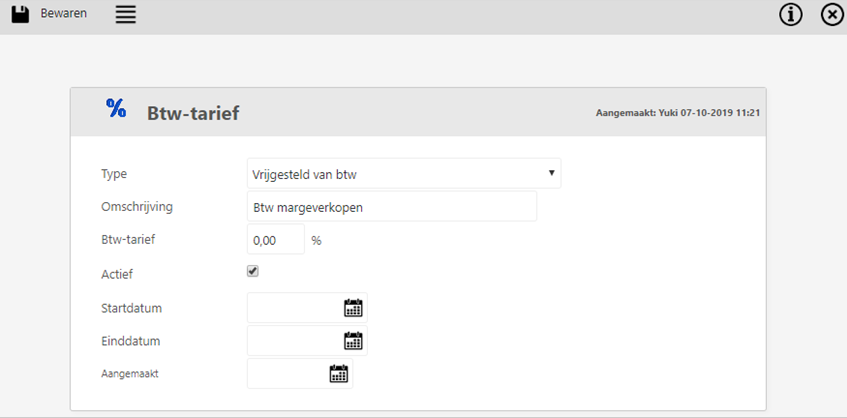

The following screen is opened:

Select the Exempt from VAT type. Enter a description of the VAT rate and then click the Save button.

Globalisation scheme

When booking both purchases and sales, transactions falling under the margin scheme must be posted to separate GL accounts, as this makes it easy to calculate the margin per period from the general ledger. So, separate accounts are maintained for margin transactions for both purchases and sales. At the end of a VAT accounting period, the profit margin is calculated by subtracting your margin purchases within that period from your margin sales within the same period. When the profit margin is positive, you multiply it by 21/121 (for 21% goods) or 9/109 (for 9% goods). You book the calculated VAT to be paid via a manual general journal entry in Yuki, as this general journal entry should not affect the calculation for the next period.

To book all purchase and sales invoices related to margin goods, you create two GL accounts: one cost of goods sold account (60000 Purchases margin goods) and one revenue account (80000 Revenue margin goods).

When booking to the relevant revenue account, you always use the VAT code 'Exempt revenue'.

Calculation of VAT to be paid on profit margin at the end of a VAT accounting period:

| Revenue margin goods | 70.000 euros |

| Purchases margin goods | 60.000 euros (-) |

| Profit margin (including VAT) | 10.000 euros |

| VAT to be paid (10.000 x 21/121) | 1736 euros (-) |

| Profit margin (excluding VAT) | 8264 euros |

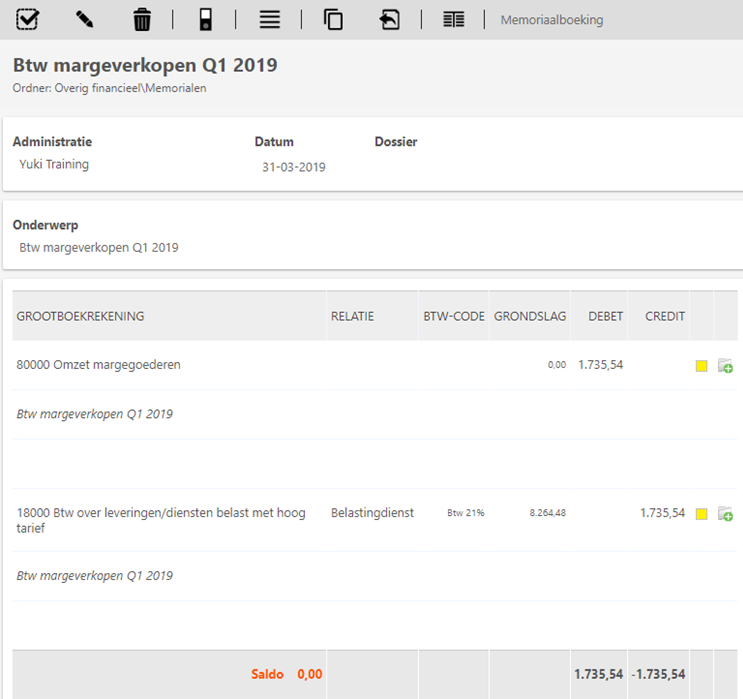

The calculated VAT to be paid (on the positive profit margin) is then entered into the VAT return in Yuki via the following general journal entry:

- 80000 Revenue margin goods, 1735.54 euros DEBIT:

- 18000 VAT on supplies/services taxed at high rate: 1735.54 euros CREDIT.

TIP!

Upload the document in which the VAT on the positive profit margin has been calculated and use this as the basis for the aforementioned general journal entry.

Travel agency scheme

A similar arrangement is used by travel agencies, the travel agency scheme. The operation largely corresponds to the margin scheme.

- The profit margin per trip cannot be offset by other trips.

- With the profit margin per period, negative margins can be offset by later positive margins.

When booking, it must be clear whether the purchases are made directly for the benefit of travelers, or whether they are other costs such as accounting fees, telephone, or similar expenses.

- Purchases made directly for the benefit of travelers are booked as purchases on separate GL accounts in the 6xxxx group without deducting VAT (even if VAT is stated on the purchase invoice!).

- We book the remaining purchases/costs net of input tax.

- We book the revenue from travel sales to separate revenue accounts 8xxxx.

- The travel agency's own revenue (for example, if the travel agency's coach is rented out) is simply subject to VAT and we book it to a different revenue account.

At the end of a VAT accounting period, the profit margin is calculated, and if it is positive, VAT is booked on it (margin x 21/121) as VAT to be paid on a contra account in the revenue group, but not the same one on which the travel revenue is booked. This booking should not influence the calculation of a subsequent period.

Once the VAT on revenue sales has been booked, the VAT return can be sent from Yuki to the tax authorities.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article