Disclaimer

All screenshots in the article were taken in the Dutch version of Yuki.

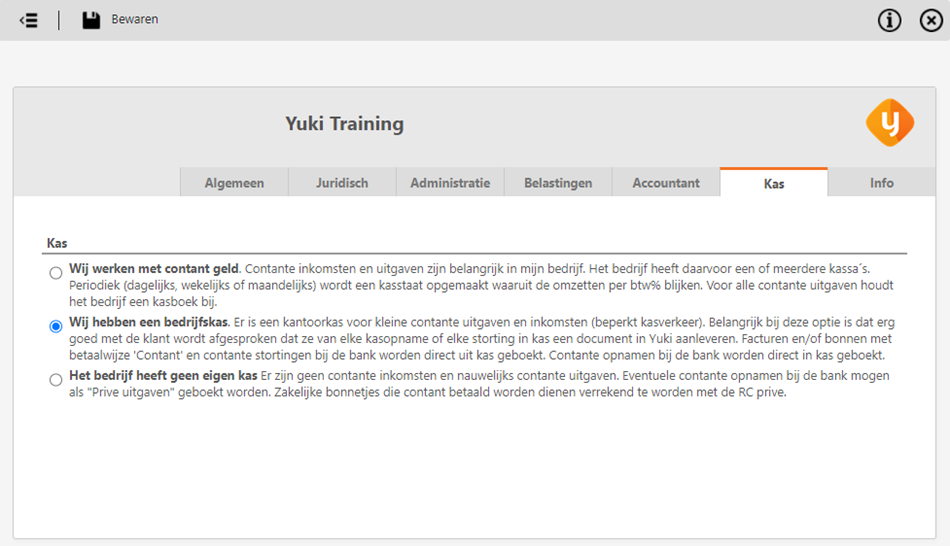

On the 'Petty cash' tab within the administration profile, you can configure how Yuki should handle cash transactions within the domain. This setting directly affects the recording of financial documents that have been paid in cash.

The screen to set this setting in the domain is opened as follows:

- Click on the Back office icon In the navigation bar and then in the now-opened screen, under Companies, click on > next to the relevant administration name to set or change the administration profile for that administration.

- Click on the Edit button to enter or change the data on the Petty cash tab.

There are three options:

- Regular cash transacions (everything is booked via a cash statement)

This is the most controllable option and should be chosen if the company deals with cash payments very regularly. If this option is chosen, amounts can only be booked in and out of petty cash by filling out documents of the type 'Cash statement'. Sales invoices marked as paid in cash go to a suspense account, as do cash withdrawals and/or deposits booked from a bank transaction. - Money box & petty cash (payment method 'Cash' is available when booking a purchase invoice)

This option is only recommended if there are limited cash transactions (money box for small expenses). Yuki will create a petty cash book in order to track cash transactions and VAT. The key with this option is that it is very clearly agreed with the customer that they will provide a document in Yuki for every cash withdrawal from or deposit into the money box. Invoices and/or receipts with the payment method 'Cash' are booked directly in the petty cash book. Cash withdrawals at the bank are booked directly in the petty cash book. Cash deposits at the bank are immediately booked out of the petty cash book. - Rare cash transactions (payment method 'From private' is available when booking a purchase invoice)

This option is very suitable for small businesses with only one owner or self-employed individuals. All cash transactions are treated as private transactions. Cash-paid invoices and receipts are considered a deposit on the private current account. Cash withdrawals from the bank (money from the ATM) are considered private withdrawals.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article